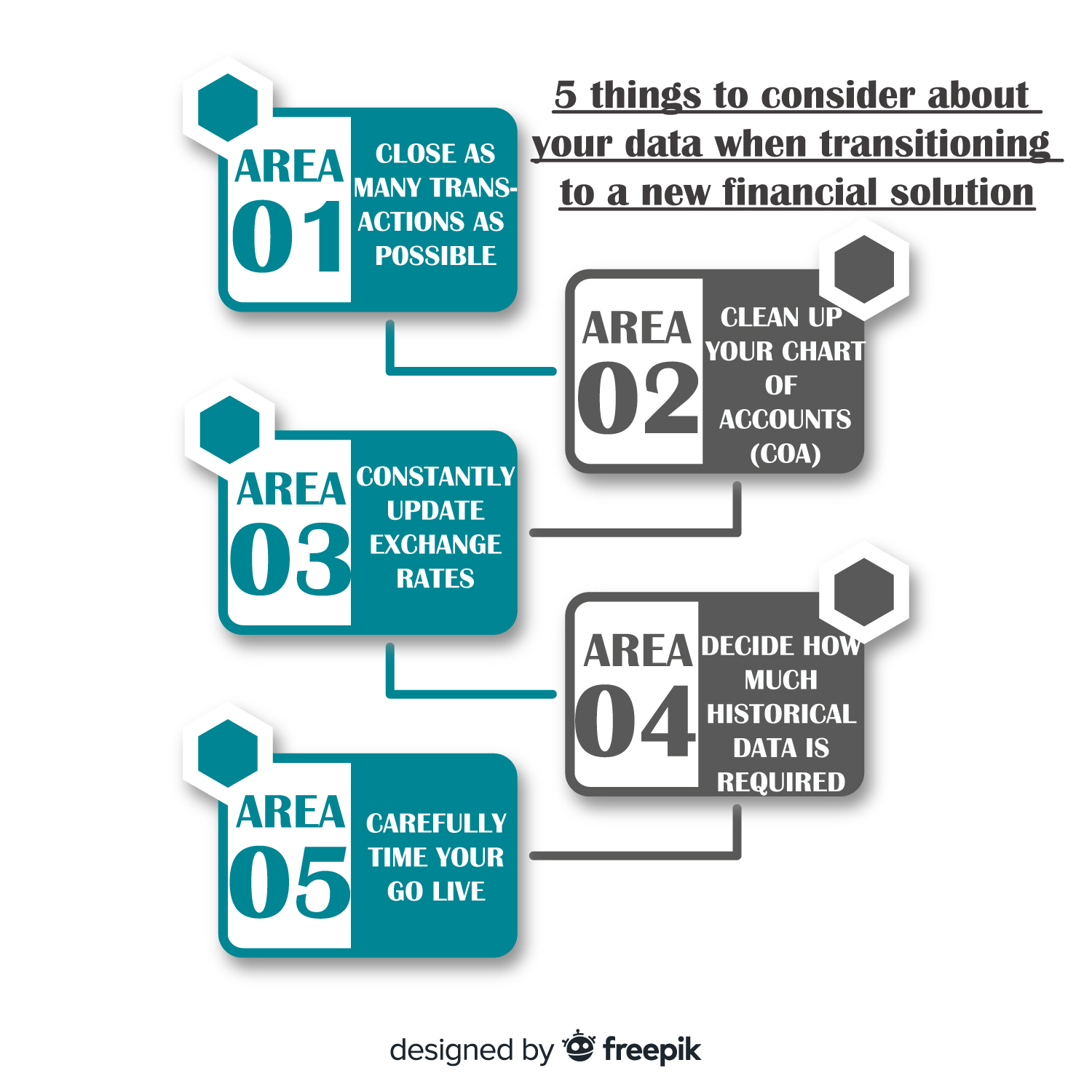

5 things to consider about your data when transitioning to a new financial solution

Once you have made the decision to invest in a new financial solution, a key element for success is to thoroughly plan for a seamless transition from one system to the next. To ensure that you get the most value out of your new solution, it’s essential that the data you transfer across is accurate and up to date. But how do you effectively plan for this? Here are 5 areas to consider:

- Close as many transactions as possible

Plainly put – the simpler the data, the easier it will be to transfer over to your new financial solution. By going through the process of closing as many transactions as possible in your legacy system, it means that you will only need to migrate your opening balances and open transactions. You may have business needs that require you to transfer across the details of the closed transaction for a specific past period. If this is the case, then it’s vital to make an assessment of the impact of this as early as possible to ensure that you allocate adequate resources to your plan.

- Clean up your Chart of Accounts (CoA)

Transitioning to a new financial solution provides you with a great opportunity to review and clean up your existing CoA. You can remove old and inactive accounts and reorganise your CoA to maximise the potential of your new system. What’s more, you don’t need to comprehensively understand your new financial solution in order to carry out this task, so planning for this can begin immediately. If your organisation has multiple entities, you may also need to consider your current set-up to ensure that your data is transferred consistently. For example, do your entities have separate CoA, is your business using more than one financial system, does your new financial solution support a single platform and single consistent CoA with regards to consolidation and reporting?

- Continuously update exchange rates

For businesses who operate overseas, problems can be encountered during the recording of many different types of foreign currency exchange rates within your financial system. In this event, you need to ensure that you have continuously updated exchange rates in order to maintain accurate information that has the relevant tax rates applied during the financial closing process. You may also want to consider if you need to take across the currency values or just the converted values to the functional currency.

- Decide how much historical data is required

It can be tempting to want to transfer all your historical data into your new financial system. However, it’s worth keeping in mind the complexities, time and cost of doing so. If your timescales and budget to move to your new financial system are tight, then you may decide not to move the data. Once you’ve gone live on your new system, you may still have access to your legacy solution for historical information or you may want to store it in a separate system. Rather than transferring historical transactions, it may be an option to bring in monthly trial balances for the previous year or two for comparative reporting.

- Carefully time your go-live

The timing of your go-live is critical to the success of your plan. Take the needs of your business into consideration and work with the Project Manager to choose a timing that strategically works for you. In theory, the first day of the month might seem like a good choice, but this would mean closing the books in your legacy system on the last day of the previous month, which could be unrealistic. To ensure a seamless transition, factor in how the changeover will affect your users and business operations and understand your existing close processes.

By taking these things into consideration right from the start and preparing your data as much as possible beforehand, the implementation of your new financial system should go smoothly and successfully, and your organisation should quickly start to realise the expected benefits of your hard work.